Iron Condor & Butterfly Options Trading Videos by San Jose Options

$15.40

Comprehensive Review of Iron Condor & Butterfly Options Trading Videos by San Jose Options – Immediate Download!

Let See The Content Inside This Course:

Description:

In the always changing world of options trading, educational materials are essential for influencing traders’ comprehension and application of different tactics. San Jose Options, which specializes in two complex yet subtle strategies—iron condor and butterfly options—emerges as a leading supplier in this market. Both new traders searching for a starting point and seasoned pros trying to hone their skills will find their video content helpful in demystifying these intricate strategies. The films have attracted attention for their capacity to improve traders’ abilities and increase their confidence in making wise judgments by providing an interesting blend of tactical advice and strategic insights.

We will examine the fundamentals of San Jose Options’ instructional materials in this post, delving into the nuances of the butterfly and iron condor options strategies. We seek to offer a thorough grasp of how these tools might empower options traders through in-depth comparisons, risk and reward profile evaluations, and an outline of accessibility characteristics.

Structure and Content of Videos

San Jose Options offers a wide range of video content that is especially made to cover the key elements of the butterfly and iron condor techniques. These movies’ approach is designed to combine theoretical justifications with real-world applications, making it easy for viewers to understand the ideas being discussed.

Every video is painstakingly made, starting with basic explanations and working its way up to more intricate subjects. For example, the sections on developing and overseeing iron condor strategies highlight important elements like implied volatility and the ways that market swings may impact possible gains. By dissecting these elements, traders can better negotiate the frequently choppy waters of options trading.

Furthermore, it is impossible to overestimate the importance of practical methods for risk mitigation. The films give traders useful tips and tactics to maximize their transactions while addressing typical traps and difficulties that they commonly face. This teaching strategy not only improves comprehension right away but also makes it easier for students to remember important ideas over time.

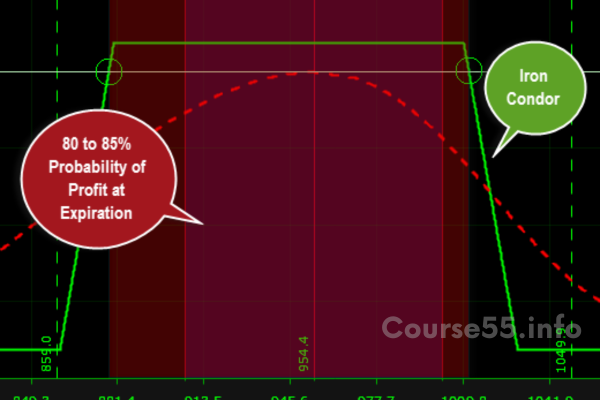

Understanding the Iron Condor Strategy

Overview

The iron condor strategy is celebrated as a low-risk, non-directional trade, appealing to traders who prefer stability in the markets. It is particularly effective for capitalizing on time decay, which occurs as options near their expiration date. The videos provided by San Jose Options dissect this strategy by illustrating how to construct and profit from it under various market conditions.

Important Elements

The significance of implied volatility is one fundamental concept that is highlighted in these movies. Traders discover that a high implied volatility level may indicate a favorable time to apply the iron condor approach. The films also shed light on how traders should evaluate market conditions in order to optimize profit margins.

- Structure: In order to mitigate risk, the technique entails simultaneously buying options that are further away from the current price and selling both an out-of-the-money call and an out-of-the-money put. When there is little volatility and steady price movements, this approach generates income.

- Profit and Loss: San Jose Options instructs traders on how to properly manage their portfolios and set reasonable expectations by describing the profit and loss possibilities.

The films provide traders the confidence to put the method into practice while carefully controlling risk, resulting in a well-rounded approach to trading.

The Butterfly Options Strategy

Overview

In contrast, the butterfly options strategy is lauded for its capability to reduce risk while generating profits in a range-bound market. Videos focused on this strategy from San Jose Options offer an exhaustive understanding of how to leverage this technique effectively.

Key Components

The butterfly strategy typically involves the sale of options at-the-money (ATM) while simultaneously hedging with out-of-the-money (OTM) options. This creates a limited risk exposure, allowing traders to benefit from stability in asset price over time.

- Risk Reduction: The key attraction of the butterfly strategy is its risk-containing nature. By defining upper and lower bands for potential losses while allowing for profit capture in tight price movements, this strategy suits traders with a cautious approach.

- Profit Profile: The videos detail a profit profile whereby traders aim for the underlying asset to remain close to the ATM strike prices at expiry, thus maximizing their gain while keeping risks manageable.

By demystifying the butterfly options strategy, San Jose Options provides traders with the knowledge necessary to navigate rapidly changing market conditions with confidence and skill.

Comparative Analysis: Iron Condor vs. Butterfly

Understanding the comparative dynamics between the iron condor and butterfly options strategies is vital for traders looking to enhance their trading repertoire. San Jose Options does an exceptional job of highlighting the similarities and differences between the two strategies in their video content.

Similarities

- Stable Price Movement: Both strategies benefit significantly from minimal price movement in the underlying asset. This correlation provides a solid foundation for traders who prefer range-bound strategies, allowing for the potential of profit without active directional bets.

- Risk Management: Each strategy allows for a degree of risk repulsion, although the extent and mechanics differ. Both are structured in a way that limits losses, a feature that appeals to risk-averse traders.

Differences

| Aspect | Iron Condor | Butterfly Options |

| Profit Potential | Typically offers broader potential but wider risk zones | Offers narrower profit potential but at a lower risk zone |

| Market Conditions | Best for stable to slightly volatile markets | Optimal in low volatility environments |

| Complexity | Seen as moderately complex | Generally viewed as less complex |

Understanding these nuances through comparison allows traders to choose strategies that align with their market outlook, risk tolerance, and overall trading philosophy.

Educational Framework

The educational framework provided by San Jose Options extends beyond just theoretical knowledge. Their videos are imbued with real-life examples and practical mentoring exercises designed to enhance the trading skills of learners at all levels.

Real-Life Applications

Traders are exposed to a variety of scenarios that illustrate how to implement iron condor and butterfly strategies in actual market contexts. This makes the learning process engaging and grounded in reality, rather than just academic exercise.

- Mentoring: Mentorship is a core part of the educational experience. By pairing visual learning with expert guidance, San Jose Options ensures that traders are not only informed but also inspired to innovate within their trading practices.

- Interactive Learning Tools: Incorporating tools such as quizzes and simulations enhances the educational experience further. These interactive elements provide immediate feedback and reinforce concepts, allowing traders to test their knowledge in a supportive environment.

Accessibility and Resources

San Jose Options is committed to making its educational resources readily accessible, ensuring that traders from various backgrounds can engage effectively with the content.

Diverse Formats

To cater to different learning styles, they offer a variety of formats including:

- Video Tutorials: In-depth video lectures that typically last between 10 to 30 minutes.

- Workshops: Interactive sessions providing hands-on experience and real-time feedback.

- One-on-One Mentoring: Personalized instructions to address specific queries and challenges experienced by traders.

Easy Learning

Because these tools are so easily accessible, traders can take their time learning the tactics. For busy people juggling trading with other work or personal obligations, this flexibility is especially helpful.

San Jose Options establishes itself as a top teaching resource in the options trading space by utilizing user-friendly interfaces and easily available content, which makes it simple for people to learn complex trading techniques.

In conclusion

To sum up, San Jose Options’ instructional videos on iron condor and butterfly options trading provide traders with a thorough road map for developing their skill sets, navigating the complexities of the market, and eventually reaching their financial objectives. These films provide a thorough examination of strategy mechanics, comparative analysis, practical implementations, and resource accessibility, making them useful resources for both new and seasoned traders. Using such structured training frameworks enables strategic competency and informed decision-making in dynamic market settings as the world of options trading continues to expand.

Frequently Requested Enquiries:

Innovation in Business Models: We employ a group buying strategy that allows customers to divide costs and receive a lower rate for popular courses. Despite content providers’ concerns about distribution tactics, this approach benefits low-income individuals.

Legal Aspects: The legality of our conduct raises a number of complex issues. Although we do not have the course developer’s official permission to redistribute their content, there are no clear resale restrictions stated at the time of purchase. We have the opportunity to provide affordable educational resources because of this uncertainty.

Quality Control: We ensure that all of the course materials we purchase are identical to those supplied by the writers. However, it is important to understand that we are not approved vendors. Consequently, our products don’t include:

– In-person consultations or phone conversations with the course developer for advice.

– Access to sites or organizations that are exclusive to authors.

– Engaging in private forums.

– Simple email support from the author or their team.

By offering these courses independently, without the premium services of the official channels, we hope to reduce the barrier to education. We appreciate your understanding of our unique approach.

Be the first to review “Iron Condor & Butterfly Options Trading Videos by San Jose Options” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.