-

×

ONLINE COURSE MULTI-PACK (Complete Rehab Programming 1+2+3) By Tim Keeley

1 × $101.00

ONLINE COURSE MULTI-PACK (Complete Rehab Programming 1+2+3) By Tim Keeley

1 × $101.00 -

×

Alpha Goddess By Hey U Human

1 × $93.00

Alpha Goddess By Hey U Human

1 × $93.00

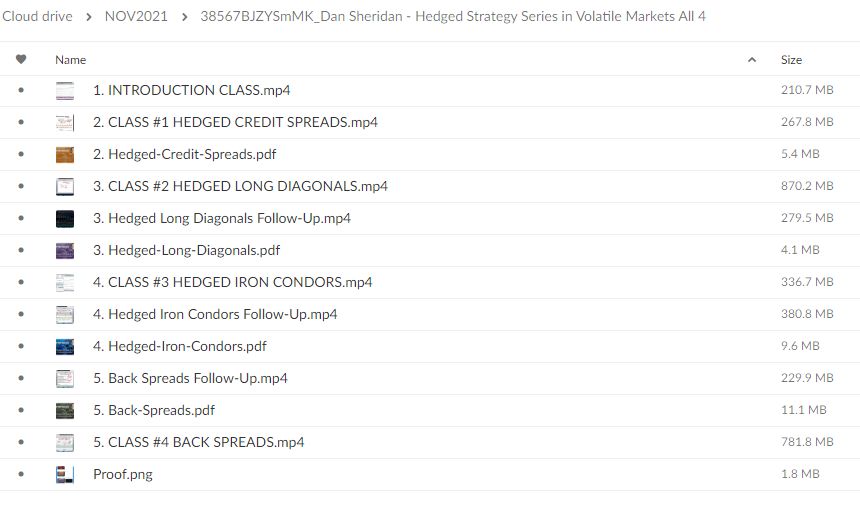

Hedged Strategy Series in Volatile Markets All 4 By Dan Sheridan

$588.00 Original price was: $588.00.$15.40Current price is: $15.40.

SKU: C55info.38567BJZYSmMK

Category: Download

Tags: Dan Sheridan, Hedged, Hedged Strategy, Volatile Markets

Hedged strategy series in volatile markets – Immediate Download!

Let See The Content Inside This Course:

Description:

It can frequently feel like sailing in stormy seas when navigating the turbulent financial markets. The possibility of capsizing, or losing money, can be frightening for traders, particularly when there is a lot of volatility. Presenting Dan Sheridan’s Hedged Strategy Series in Volatile Markets, a revolutionary method designed for people who want to not only survive but also prosper in unpredictable circumstances. This extensive four-part series is intended to provide participants with useful hedging techniques for controlling risks and increasing possible gains. Having worked in options trading and education for more than thirty years, Sheridan helps traders of all skill levels gain greater financial confidence by demystifying complicated ideas with relatable examples and risk management strategies.

The Hedged Strategy Series: An Overview

Knowing how educational offerings are structured is essential in the complex world of trading. The four separate seminars that make up Sheridan’s series are skillfully structured to concentrate on different hedging techniques: Hedged Credit Spreads, Hedged Long Diagonals, Hedged Iron Condors, and Back Spreads. In addition to making the material easier to understand, this division enables participants to investigate certain trading tactics that suit their trading preferences.

Every session contributes to the overall theme of risk management in some way. By providing traders with the means to withstand market volatility, these techniques foster a sense of security and readiness, much like building a strong ship for a stormy sea. Participants learn how to minimize losses while still taking advantage of advantageous market movements by concentrating on efficient hedging strategies.

The Professional Who Develops the Plans

Dan Sheridan is more than just a name; he is a representation of knowledge and proficiency in the field of options trading. Having worked at the Chicago Board Options Exchange for more than 30 years, Sheridan has a lot of experience that can help new traders become skilled market navigators. His method is known for being approachable; instead of being buried in technical jargon, his lessons are delivered in a way that traders of all skill levels can understand.

The interactive elements of the series demonstrate Sheridan’s dedication to education. He offers participants the rare chance to interact directly, which enables concept clarification and a more individualized educational experience. Through real-world examples, the extensive curriculum highlights practical applications, reaffirming the notion that theory without practice is like a ship without sails.

A Comprehensive Analysis of Every Strategy

Each particular strategy offers unique benefits and approaches for risk management in the face of market volatility as traders progress through the series. It is essential for traders to comprehend these distinctions in order to modify their strategy to suit their particular situation.

Hedged Credit Spreads

The Hedged Credit Spread is akin to setting up a protective barrier against unfavorable price movements. By simultaneously buying and selling options at different strike prices, traders can create a position that limits their potential losses while still retaining a profit opportunity. This strategy effectively balances risk and reward, much like a safety net for a high-wire performer.

Pros and Cons of Hedged Credit Spreads:

| Pros | Cons |

| Limited risk potential | Potentially lower profits |

| Flexibility in choosing strike prices | Requires precise market predictions |

| Enhanced profit opportunities | Transaction costs may add up |

In volatile markets, the ability to limit risk while maintaining profit potential can make a significant difference. Sheridan’s approach to this strategy is straightforward yet powerful, providing traders with actionable insights that can be implemented immediately.

Long Hedged Diagonals

Traders can experiment with a technique that skillfully blends the traits of long and short positions by switching to Hedged Long Diagonals. This method enables traders to profit from the time decay of options while hedging against price swings by holding both a long and a short option with separate expiration dates and strike prices.

This strategy achieves equilibrium in spite of the market’s changing environment, much like a talented dancer balancing opposing forces. As the market changes and the trader adjusts to the movement’s rhythm, the possibility of profit increases.

Advantages and Disadvantages of Hedged Long Diagonals:

| Advantages | Disadvantages |

| Adaptable to various market conditions | Complexity in management |

| Potential for consistent income | Requires active monitoring |

| Leverage of time decay | Uncertain margin requirements |

Sheridan emphasizes the importance of understanding both the mechanics and emotional aspects of this strategy, guiding participants to embrace the adaptability it offers. Successful execution requires a combination of precision and agility, much like a seasoned acrobat navigating a tightrope.

Mastering the Iron Condors and Back Spreads

Now, the stage is set for two more strategies – Hedged Iron Condors and Back Spreads. Each offers unique approaches toward risk management and profit maximization, tailored for different trading philosophies.

Hedged Iron Condors

The Hedged Iron Condor strategy is reminiscent of a fortress built to withstand assaults from various directions. Traders implement this by selling a combination of call and put spreads, effectively profit from a stagnant market. However, introducing a hedging component can help protect against unpredictable price swings, ensuring stability in uncertain conditions.

Key Features of Hedged Iron Condors:

| Feature | Description |

| Profit Range | Limited, but achievable through adjustments |

| Risk Limitation | Can be minimized by strategic hedging |

| Market Neutrality | Designed to profit in sideways markets |

The flexibility of the Iron Condor lays the groundwork for numerous adjustments, allowing traders to tread carefully through market fluctuations. By preparing for different scenarios, one can maintain balance amid chaos.

Back Spreads

Finally, Back Spreads can be considered as the trump card in volatile markets. This strategy involves buying additional call or put options beyond standard hedging. While it carries a greater risk, it offers substantial rewards during strong market moves. It is akin to placing a bet on high volatility, where the stakes and potential rewards can be significant.

Overview of Back Spreads:

| Aspect | Details |

| Risk Exposure | High, but managed with proper structure |

| Reward Potential | Significant in cases of marked market movement |

| Complexity | Requires thorough understanding of market dynamics |

Sheridan expertly navigates through the intricacies of this strategy, ensuring participants grasp both the risks and rewards. It requires a bold approach, encouraging traders to embrace uncertainty as an opportunity for growth.

In conclusion

Dan Sheridan’s Hedged Strategy Series in Volatile Markets is a lighthouse of advice for navigating the choppy seas of trading. It gives traders priceless insights into successful risk management techniques with its interactive elements, organized curriculum, and focus on real-world applications. This series contains the secret to maximizing possible gains while reducing exposure to market volatility, regardless of your level of experience as a trader.

By entering this extensive learning program, traders are gaining tools and tactics that can greatly improve their trading journey rather than just consuming knowledge. Participants are not only surviving the market’s turbulence but also navigating it with resilience and confidence by adopting the lessons Sheridan articulated.

Frequently Requested Enquiries:

Innovation in Business Models: We employ a group buying strategy that allows customers to divide costs and receive a lower rate for popular courses. Despite content providers’ concerns about distribution tactics, this approach benefits low-income individuals.

Legal Aspects: The legality of our conduct raises a number of complex issues. Although we do not have the course developer’s official permission to redistribute their content, there are no clear resale restrictions stated at the time of purchase. We have the opportunity to provide affordable educational resources because of this uncertainty.

Quality Control: We ensure that all of the course materials we purchase are identical to those supplied by the writers. However, it is important to understand that we are not approved vendors. Consequently, our products don’t include:

– In-person consultations or phone conversations with the course developer for advice.

– Access to sites or organizations that are exclusive to authors.

– Engaging in private forums.

– Simple email support from the author or their team.

By offering these courses independently, without the premium services of the official channels, we hope to reduce the barrier to education. We appreciate your understanding of our unique approach.

Be the first to review “Hedged Strategy Series in Volatile Markets All 4 By Dan Sheridan” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.