-

×

Rebirth By Hey U Human

1 × $93.00

Rebirth By Hey U Human

1 × $93.00

The SPX 35-40 Day Delta Neutral Unbalanced Butterfly By Sheridan Options Mentoring

$247.00 Original price was: $247.00.$15.40Current price is: $15.40.

SKU: C55info.38851uvJKPhIh

Category: Download

Tags: 35-40 Day, Delta Neutral, The SPX, Unbalanced Butterfly

Review of the SPX 35-40 Day Delta Neutral Unbalanced Butterfly by Sheridan Options Mentoring – Immediate Download!

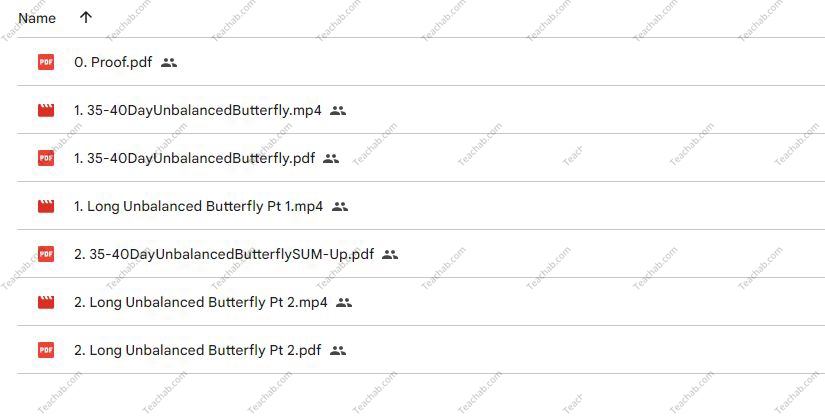

Let See The Content Inside This Course:

Description:

The SPX 35-40 Day Delta Neutral Unbalanced Butterfly stands out as a point of clarity and possible profit in the enormous ocean of trading methods. This approach, which was created via the perceptive perspective of Sheridan Options Mentoring, functions similarly to a well-made compass in assisting both new and experienced traders in navigating the volatile financial market.

It provides a systematic framework that promises not only survival but also flourishing in the face of fluctuating market conditions, opening the door to the world of options trading. It’s an offer to refine your abilities in a setting where comprehension and application meet, not just a tactic. This course is a great resource for anyone wishing to improve their understanding of options trading because it emphasizes both technicalities and a comprehensive approach to trading.

Overview of the SPX Delta Neutral Unbalanced Butterfly Strategy

At its core, the SPX 35-40 Day Delta Neutral Unbalanced Butterfly strategy encapsulates the principles of theta positive trading, designed to withstand the ebbs and flows of market dynamics. This section will delve into the foundational elements that make this strategy appealing and versatile.

Mechanics of the Butterfly Strategy

The butterfly spread encapsulates a range of opening strategies that can be pivotal for traders seeking stability in a fluctuating market. It is important to understand that the mechanics of this strategy focuses on creating a position where the trader stands to benefit from a consolidating market trend over a specified duration.

- Setup of the Trade: The initiation of a butterfly strategy involves involved transaction to establish a position where one can profit from minimal movement in the underlying asset, such as the SPX Index. Traders will buy one option at a lower strike price, sell two options at the middle strike price, and buy one option at a higher strike price, thus creating a “winged” profile that resembles a butterfly.

- Determining the Width of the Wings: The wings’ width, which refers to the differences between the strike prices in the spread, plays a significant role in shaping potential returns as well as risk exposure. Established traders often utilize historical volatility and current market conditions to precisely configure their ‘wings’ for optimized performance.

- Managing Risk: In the world of trading, risk management stands as the robust lifeboat amidst turbulent seas. Participants will learn how to adjust their positions in response to adverse market movements, ensuring that they minimize losses while capitalizing on potential opportunities.

Important Trading Ideas

Gaining an understanding of this strategy’s nuances will open a treasure trove of fundamental ideas. Here, we shed light on some of the most important components.

- Risk management: The course teaches students how to keep a close eye on not only the position delta but also the other Greeks that affect options trading, such as delta, gamma, theta, and vega. Equipped with this understanding, traders are better able to handle unfavorable changes in the market environment.

- The state of the market Executing the butterfly trade requires an understanding of ideal circumstances, such as minimal volatility and time decay. The method is most effective in situations where there is little movement in the underlying stock, enabling the trader to profit from the time decay of dormant options.

- Empowering Confidence: This course’s practical approach highlights the need of gaining self-assurance when trading by stressing the capacity to effectively participate in actual market situations using theoretical knowledge.

Gaining Practical Experience

One of the most admirable features of the SPX Delta Neutral Unbalanced Butterfly course by Sheridan Options Mentoring is its practical application focus.

- Real Market Application: Graduates of the course are anticipated to translate their theoretical knowledge into real market execution, significantly boosting their trading acumen. Think of it as acquiring a map that, once obtained, allows the trader to traverse the trading landscape effectively.

- Multimedia Learning Materials: To enhance the overall learning experience, the course incorporates various formats, including PDFs and videos. This blended learning approach supports different learning styles, ensuring that information is easily digestible and readily applicable.

The Versatility of the Strategy

Now that we have dissected the mechanics and key concepts of this strategy, it’s time to explore its versatility and adaptability in diverse market environments.

All-Weather Butterfly

The designation of the SPX Delta Neutral Unbalanced Butterfly as an “all-weather butterfly” aptly summarizes its ability to perform favorably under various market conditions one might encounter:

- Bullish, Bearish, and Neutral Markets: Whether the market is bullish, bearish, or neutral, this strategy maintains a foothold, adeptly adjusting to prevailing conditions. This omnipresent nature sets it apart in a field filled with often one-dimensional strategies.

- Efficiency in Volatility: One of the unique aspects is its inherent efficiency in environments characterized by low volatility, where time decay becomes a friend rather than a foe. Participants often find their works rooted in substantial theoretical knowledge that translates seamlessly into robust practical application.

- Flexibility in Adjusting Positions: The ability to manage and adjust positions in response to market changes serves as a safety tether for traders. It is this flexibility that allows participants to remain in the game even when prevailing currents might suggest pulling back.

Potential Returns and Drawbacks

Like any strategy, a thorough understanding of potential returns and drawbacks complements its appeal.

- Potential for Profit: By leveraging time-value decay and executing effective spreads, traders positioned correctly can reap significant rewards, with possibilities stretching from a moderate to impressive profit based on initial investments.

- Risks Involved: Nevertheless, one must remain cognizant of potential downsides, such as executing trades in the far wings which might lead to unexpected losses.

In conclusion

We have revealed the fundamental workings, broad range of applications, and powerful influence on trading techniques of the SPX 35-40 Day Delta Neutral Unbalanced Butterfly by Sheridan Options Mentoring in this in-depth analysis. Fundamentally, this approach provides a friendly sanctuary for traders negotiating the frequently choppy waters of options trading. It encourages individuals to change, grow, and adapt throughout time, equipping them to take advantage of opportunities and deftly avoid pitfalls.

In the end, taking this course as a trader represents a dedication to learning the craft of options trading as well as an investment in information. The ability to successfully apply the butterfly technique is a crucial skill that will help any trader on their path to financial success as markets continue to fluctuate between opportunities and uncertainties.

Frequently Requested Enquiries:

Innovation in Business Models: We employ a group buying strategy that allows customers to divide costs and receive a lower rate for popular courses. Despite content providers’ concerns about distribution tactics, this approach benefits low-income individuals.

Legal Aspects: The legality of our conduct raises a number of complex issues. Although we do not have the course developer’s official permission to redistribute their content, there are no clear resale restrictions stated at the time of purchase. We have the opportunity to provide affordable educational resources because of this uncertainty.

Quality Control: We ensure that all of the course materials we purchase are identical to those supplied by the writers. However, it is important to understand that we are not approved vendors. Consequently, our products don’t include:

– In-person consultations or phone conversations with the course developer for advice.

– Access to sites or organizations that are exclusive to authors.

– Engaging in private forums.

– Simple email support from the author or their team.

By offering these courses independently, without the premium services of the official channels, we hope to reduce the barrier to education. We appreciate your understanding of our unique approach.

Be the first to review “The SPX 35-40 Day Delta Neutral Unbalanced Butterfly By Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Reviews

There are no reviews yet.